What Kasy Proposes:

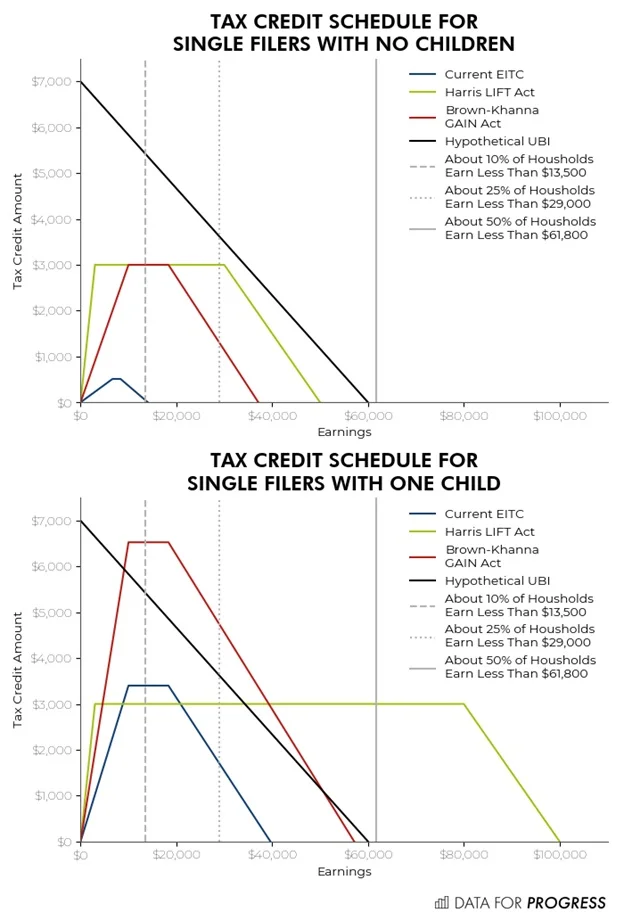

Kasy puts forward a proposal to expand the Earned Income Tax Credit (EITC) into a universal basic income. A hypothetical universal (or unconditional) basic income (UBI), which is an unconditional cash payment to every person, is also shown. In Kasy’s proposal, individuals with no income receive the highest net benefit, and as incomes increase a larger portion of the UBI is taxed back, decreasing the net benefit.

Kasy argues there are a number of reasons why a UBI is preferable to an EITC. First, the EITC and other subsidies for low-wage work cause people to work more than they otherwise would, since there is an incentive to increase work to maximize EITC benefits. As people work more, this ultimately increases the amount of money the government needs to pay out. According to Kasy, this is less efficient than simply offering unconditional transfers to everyone.

Second, subsidizing low-wage work depresses wages by essentially allowing employers to pay less than a livable wage, so EITC-type benefits are at least in part a transfer to employers, rather than workers. On the other hand, unconditional transfers actually improve workers’ bargaining power by giving them the leeway to refuse work. By its very nature, the EITC work requirement excludes those who are unable to work or unable to find a job, which limits coverage in addition to distorting incentives.

Maximilian Kasy is an Associate Professor of Economics at Harvard.