Climate Change Poses a Risk to Our Economy — and Voters Want the Government to Act

by Danielle Deiseroth, Senior Climate Strategist, Data for Progress

Key Findings:

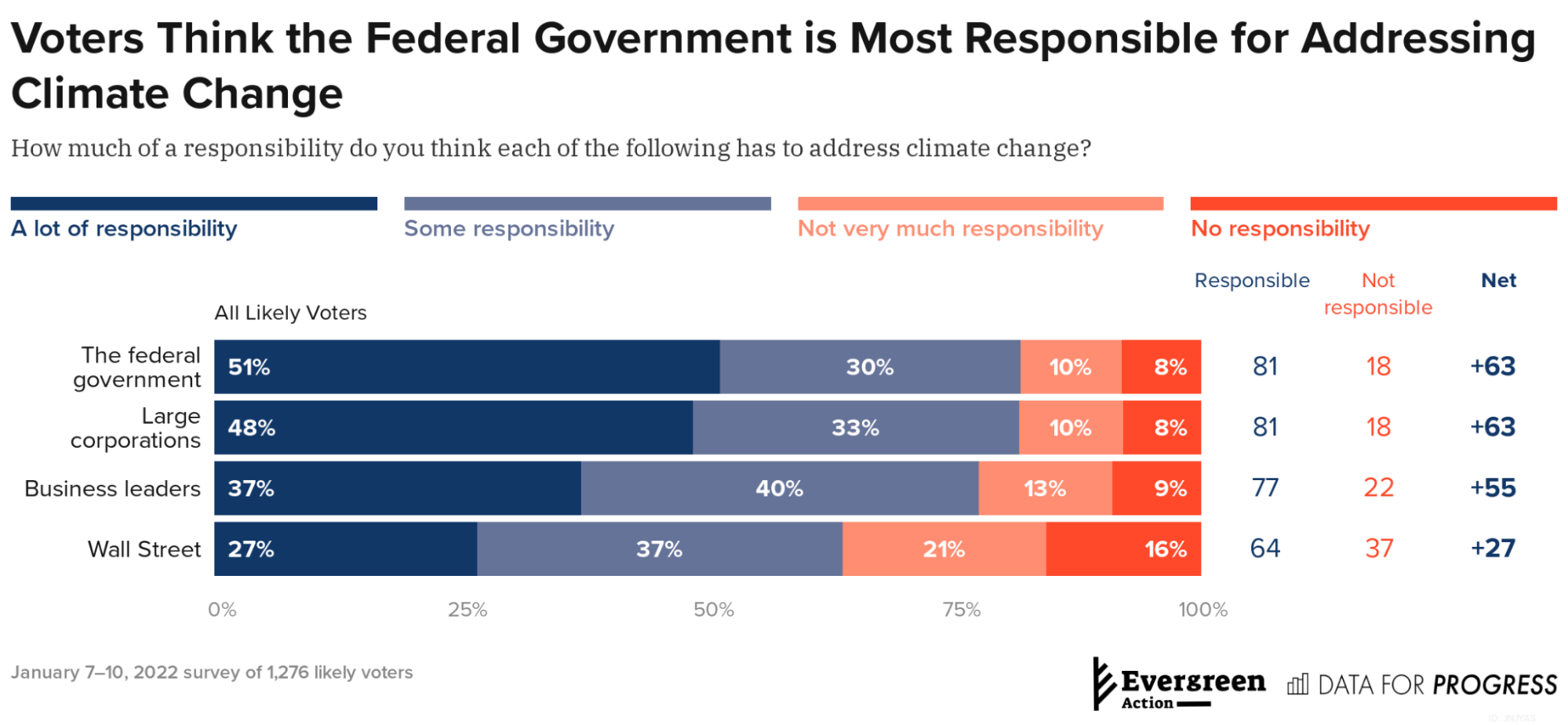

An overwhelming majority of voters (81 percent) think the federal government is “very” or “somewhat” responsible for addressing climate change

Only 45 percent of voters say they have “a great deal” or “some” confidence in the government’s ability to prevent a financial crisis

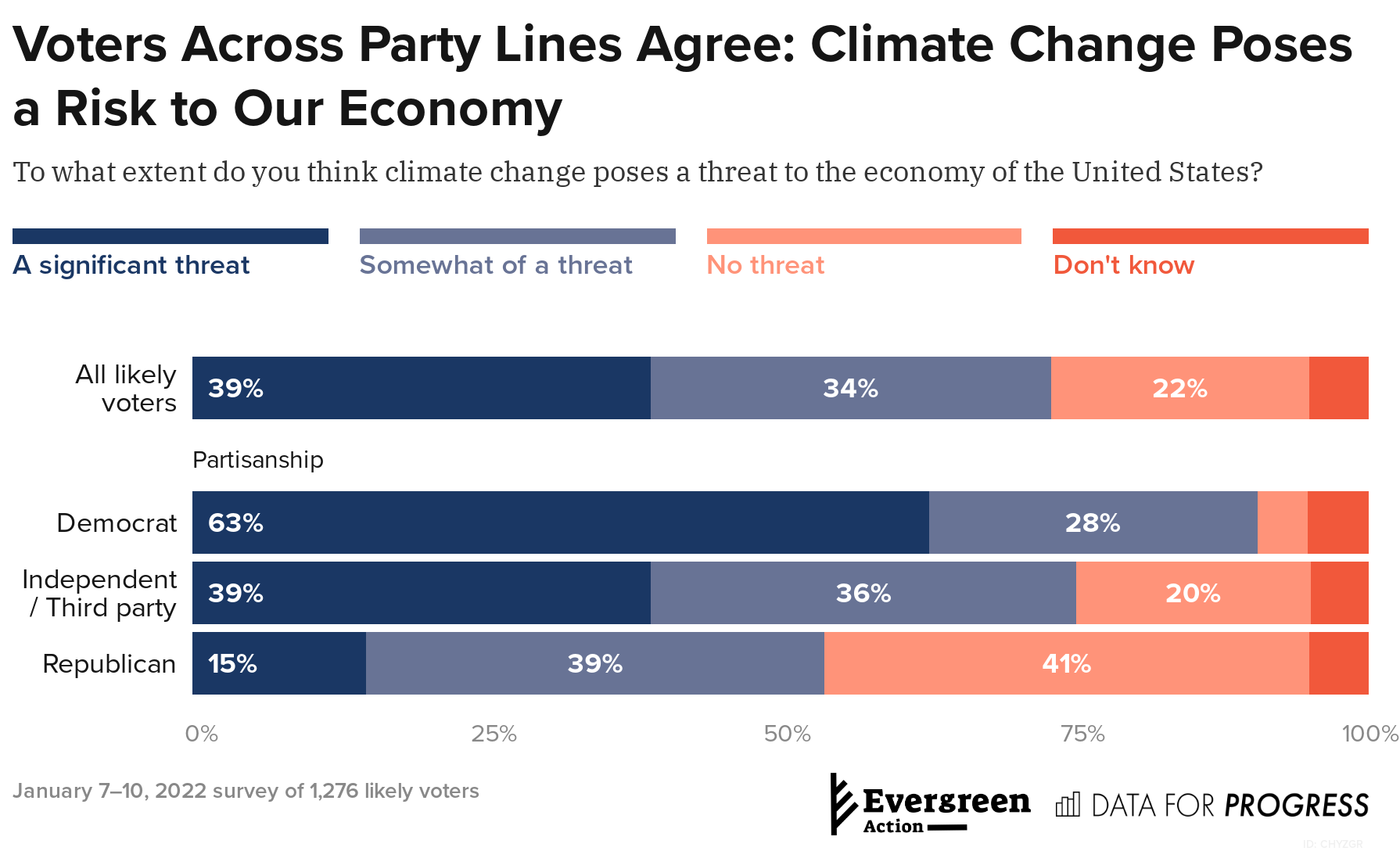

Roughly three-quarters of voters (73 percent) think climate change poses a “significant threat” or “somewhat of a threat” to the U.S. economy.

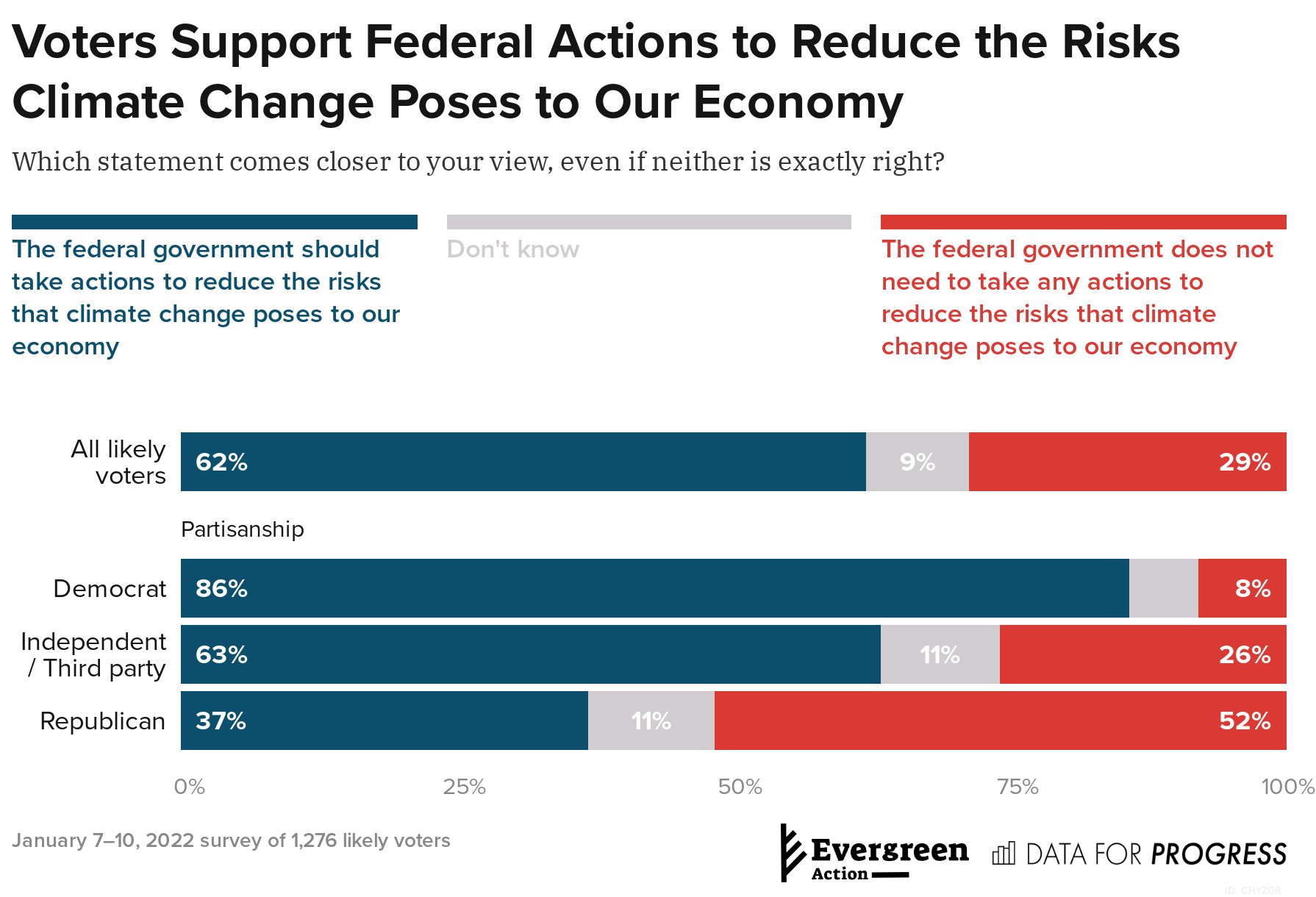

A majority of voters (62 percent) think the federal government should take actions to minimize climate-related financial risks

Earlier this month, President Biden announced the nomination of a serious, qualified slate of candidates to serve on the Federal Reserve Board of Governors. Sarah Bloom Raskin, Lisa Cook, and Phillip Jefferson will bring a wealth of experience and long-needed diversity to the leadership of the Fed and will be well equipped to tackle the emerging challenges that pose a threat to our entire financial system. After the 2008 financial crisis, lawmakers passed the Dodd-Frank Act so federal regulators could prevent future disruptions to the stability of our financial system. As climate change continues to intensify extreme weather and natural disasters — which cost an estimated $145 billion to address in 2021 — the new leadership of the Federal Reserve must grapple with climate change's threat to our economy.

In a January 2022 national survey, Data for Progress and Evergreen Action asked likely voters several questions about the impact of climate change on the U.S. financial system. We find that voters across party lines recognize climate change as a risk to our economy and overwhelmingly agree that the federal government should take action to reduce those risks.

First, we asked voters how much responsibility the federal government, large corporations, business leaders, and Wall Street have to address climate change. Notably, voters think the federal government and large corporations have the most significant responsibility in addressing climate change, closely followed by business leaders. Meanwhile, nearly two-thirds of voters (64 percent) think that Wall Street has “a lot” or “some” responsibility to address climate change.

Next, we asked voters how much confidence they have in the federal government to prevent a financial crisis. Overall, we find only 45 percent of voters say they have “a great deal” or “some” confidence in the government’s ability to prevent a financial crisis. While Democrats are the most optimistic — 70 percent say they have “a great deal” or “some” confidence — 61 percent of Independents and 79 percent of Republicans say they have “not much” or no confidence in the government’s ability to prevent a financial crisis.

We then asked voters how much of a threat they think climate change poses to the economy of the United States. Nearly three-quarters of all voters (73 percent) — including majorities of Democrats (91 percent), Independents (75 percent), and Republicans (54 percent) — think climate change poses a “significant threat” or “somewhat of a threat” to the U.S. economy.

Finally, we asked voters whether they think the federal government should take action to reduce the threat that climate change poses to our economy. By a +33-point margin, voters agree that the federal government should intervene to minimize climate-related financial risks. Nearly all Democrats (86 percent), a majority of Independents (63 percent), and over a third of Republicans (37 percent) agree with this viewpoint.

With voters across party lines agreeing that climate change threatens our economy, the federal government must act. While financial institutions like BlackRock have acknowledged the risk that climate change poses to the global economy, the Federal Reserve has the regulatory muscle and the federal mandate to ensure that the entire U.S. financial system accurately assesses and minimizes the risk that climate change poses to our future. Evergreen Action has detailed five concrete steps that the Federal Reserve must take to measure and mitigate the risk that climate change poses to our economy. As the Senate moves to confirm the senior leadership of the Federal Reserve, both lawmakers and the nominees — Raskin, Cook, Jefferson, Jerome Powell, and Lael Brainard — should feel confident acknowledging the role that our nation’s central bank must play in preventing a future financial crisis driven by climate change.

Survey Methodology:

From January 7 to 10, 2022, Data for Progress conducted a survey of 1,276 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.

Danielle Deiseroth (@danielledeis) is the Senior Climate Strategist at Data for Progress.