Voters Want the IRS to Crack Down on Tax Evasion By The Wealthy

By David Guirgis

By its own admission, the IRS audits workers and poor people at the same rate it audits the wealthiest 1 percent of Americans. The agency, which has long suffered from budget cuts and staff shortages, has seen at least $1 trillion lost in tax revenue each year from people who fail to file taxes alone. In order to make up its continued shortfall, the IRS has focused what little auditing power it has left on people who receive the Earned Income Tax Credit (EITC) — in part because of Republican pressure, but mainly because it takes up fewer resources to audit the poor than it does to audit the rich.

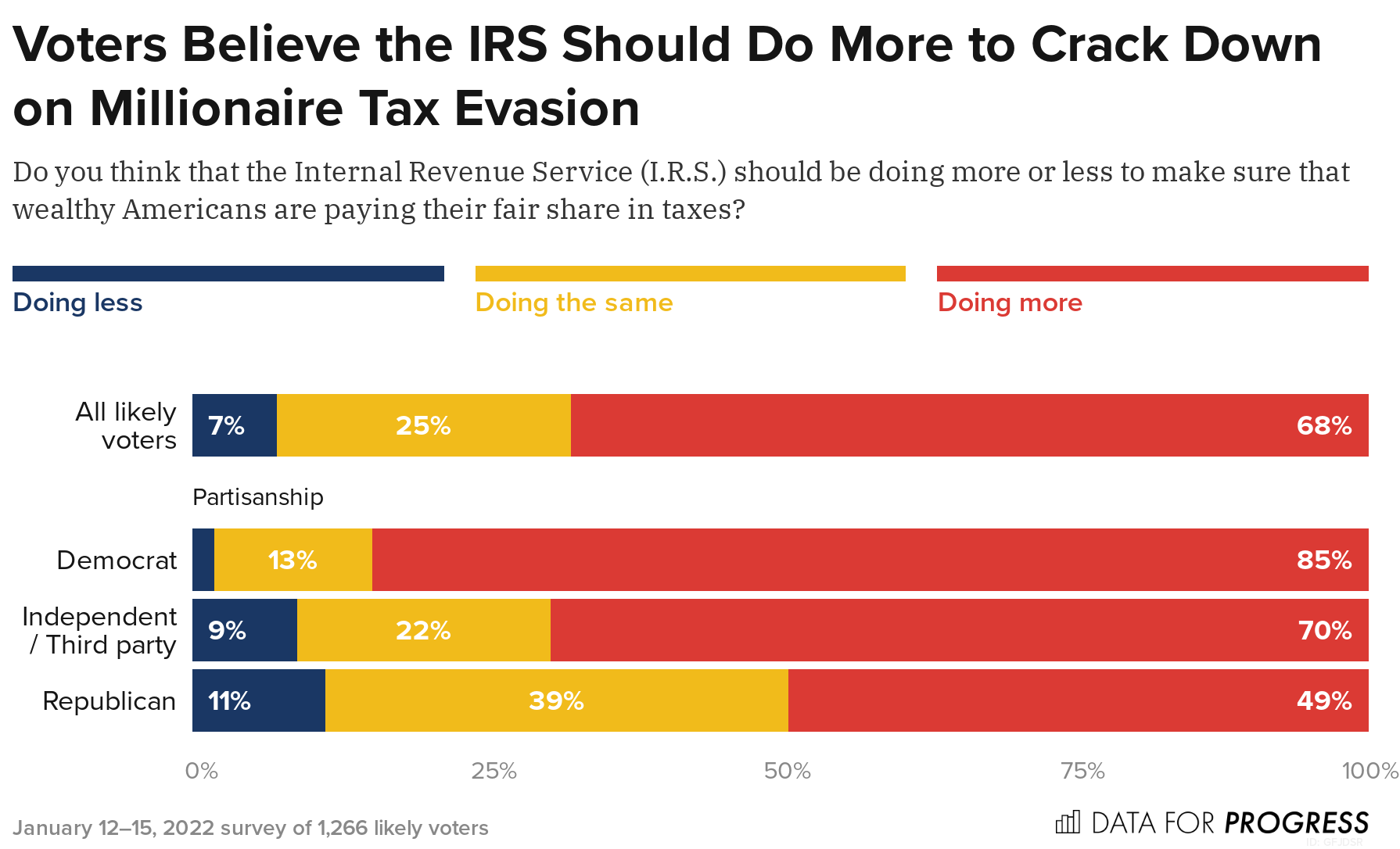

Broadly, a wealth tax is already popular among voters: 67 percent of voters believe that the wealthy should be paying more in taxes. But in addition to a wealth tax, voters want increased government oversight over the tax filings of the rich: In a new poll by Data for Progress, an overwhelming majority of all voters, 68 percent, said they believe that the IRS should be doing more to make sure that wealthy Americans are paying the amount of taxes that they owe.

Additionally, when voters are informed that, from 2010 to 2018, the IRS tax audit rate for large corporations decreased by 51 percent and for millionaires by 61 percent, a strong majority of them say the IRS should conduct more tax audits of large corporations: 73 percent overall, including 85 percent of Democrats, 72 percent of Independents, and 60 percent of Republicans.

It is clear that voters want fairer and more equitable tax codes. After two years of staggering loss of income and security for workers, during which the rich have only gotten richer, it’s time for the federal government to fully fund the IRS so that it has the resources to strong-arm recalcitrant millionaires and billionaires into paying their fair share of taxes.

David Guirgis is a writing fellow at Data for Progress.