Senator Warren: Filing Taxes Should Be Free, Fast, and Easy

By Senator Elizabeth Warren

This past tax season, American taxpayers spent 13 hours and $240 on average filing their taxes, according to IRS estimates — a cost equal to almost 10 percent of the average federal tax refund in 2021.

The IRS already has information like your W-2 income, so why is it so difficult and expensive to file your taxes? You can blame private tax preparation companies like Intuit, which have raked in billions by rigging our tax filing system and scamming hardworking Americans into paying for tax filing services that should be free.

Intuit, H&R Block, and other private tax prep companies lobbied intensively to set up a partnership with the IRS called the Free File program, supposedly to provide free tax filing services to 70 percent of taxpayers. In reality, only 3 percent of taxpayers use Free File. But it’s no surprise that millions of low-income Americans do not take advantage of this tax benefit. Intuit has designed TurboTax to trick filers into paying for the services that should be free. And Free File users have no choice but to share sensitive financial information with a private third party — even though an audit found that nearly half of Free File companies fail to adequately protect taxpayer data from cybercriminals.

It’s time to make filing taxes free, fast, and easy. That’s why the Government Accountability Office recently recommended that the IRS develop alternatives to Free File. Treasury analysts have also suggested that the IRS could go even further in developing easy filing options. They estimated that returns for up to 48 percent of taxpayers could be accurately pre-populated — and help deliver unclaimed refunds to 8 million non-filers. And Treasury Secretary Janet Yellen recently agreed with me on the need to invest in simplified filing tools.

I’ve proposed legislation, the Tax Filing Simplification Act, cosponsored by 22 of my Senate colleagues, to simplify the tax filing process for millions of American taxpayers, lower costs, and decrease the burden on the IRS.

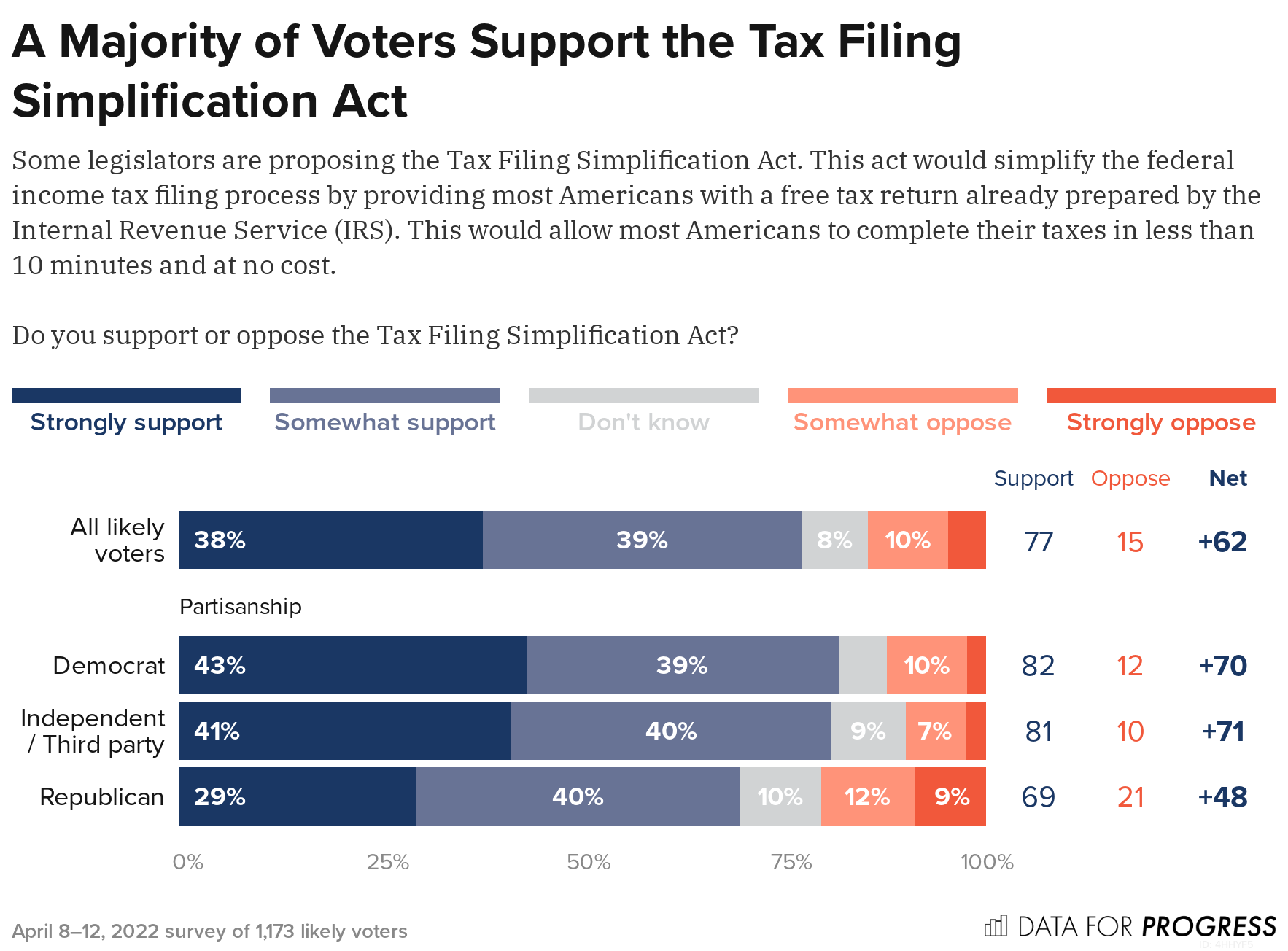

A new poll from Data for Progress finds that a majority of voters support my Tax Filing Simplification Act by a +62-point margin. This critical piece of legislation would simplify the federal income tax filing process by allowing millions of Americans to receive a tax return already prepared by the IRS. Simplified filing would allow most Americans to complete their taxes in less than 10 minutes and at no cost.

With simplified filing, American taxpayers could plug in IRS data, maybe make a tweak or two, and then send it in minutes, instead of hours — and without padding Intuit’s profits.

National Taxpayer Advocate Erin Collins agrees that a simplified filing tool, as proposed in my Tax Filing Simplification Act, would help increase tax return accuracy, decrease the IRS backlog, and reduce processing times for taxpayers.

Americans across the political spectrum understand that this policy is long overdue. It’s past time to put Americans before tax prep company profits and make filing taxes free, fast, and easy.

Senator Elizabeth Warren (@SenWarren) is a Democrat from Massachusetts.