NY-22 Voters Oppose Cuts to Social Security and Raising the Retirement Age, Support Taxes on Corporations and the Wealthy

By Isa Alomran and Kevin Hanley

Since President Biden vowed to block cuts to Social Security and Medicare during his State of the Union address, the two programs, in conjunction with the looming debt ceiling deadline, have dominated headlines. Most recently, concerns about Social Security and Medicare’s fiscal futures were intensified by trustee reports estimating the programs’ inability to pay benefits in full beyond the early 2030s.

While these reports have renewed calls for Congress to take action, the path forward remains unclear. Some lawmakers in Congress are reportedly considering a package of reforms that would include raising the retirement age to 70 and investing Social Security’s funds in the stock market, while others have called for an increase in taxes on corporations and the wealthiest Americans to shore up the programs’ fiscal standing and guarantee their future.

Recent Data for Progress polling underscored the popularity of Social Security and Medicare among likely voters nationwide, including bipartisan support for imposing payroll taxes on Americans making more than $250,000 per year to fund expanded benefits and extend the program’s solvency, and raising the debt ceiling without forcing cuts to programs like Medicare.

Now, in an April poll of likely voters in New York’s 22nd Congressional District, we find much of the same support for Social Security and Medicare, including strong bipartisan opposition to benefit cuts and raising the retirement age, and overall support of increased funding for both programs.

Across the district, we find that voters have a strong preference for leaving the retirement age as is or lowering it back to 65 years: 42 percent of voters favor maintaining the status quo, while 49 percent back lowering the retirement age. Meanwhile, only 7 percent of voters think we should raise it to 70. This sentiment is consistent across partisanship: 94 percent of Democrats, 90 percent of Independents, and 91 percent of Republicans all favor leaving the retirement age as is or lowering it to 65 years.

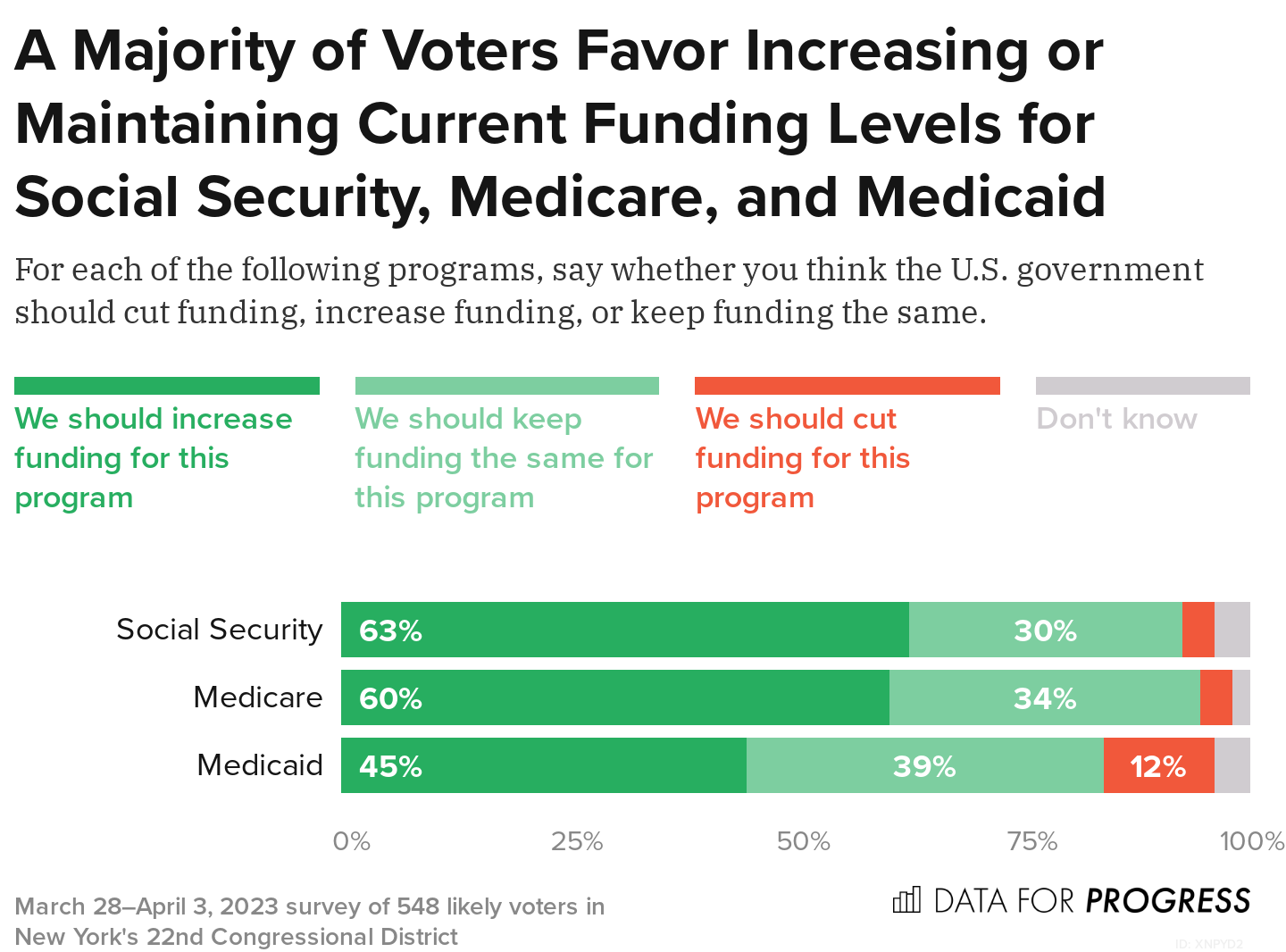

Moreover, we find strong voter support for maintaining or increasing current funding levels for Social Security, alongside Medicare and Medicaid. Specifically, 30 percent of voters support maintaining Social Security’s current funding while 63 percent support increasing it. Similarly, 34 percent and 39 percent support maintaining status quo funding for Medicare and Medicaid, respectively, while 60 percent and 45 percent support increasing funding.

We informed voters of Social Security’s potential inability to pay out full benefits by 2034, and then asked them if they would support or oppose cutting program benefits. We find that voters overwhelmingly oppose cutting Social Security benefits by a -78-point margin (10 percent support, 88 percent oppose). Democrats, Independents, and Republicans all strongly oppose cuts, by -82-point, -77-point, and -71-point margins, respectively.

Indeed, when asked whether they would prefer to raise taxes on the wealthy or reduce benefits to retirees in order to protect the program’s solvency for future generations, voters overwhelmingly prefer the former. Overall, 82 percent of voters prefer raising taxes on the wealthy to maintain Social Security, including 97 percent of Democrats, 79 percent of Independents, and 71 percent of Republicans.

We also measured voter sentiment around another proposed Social Security reform: reducing the program’s cost of living adjustments. We find that, overall, likely voters strongly oppose this proposed change, by a -64-point margin. Democrats, Independents, and Republicans oppose it by -61 points, -70 points, and -61 points, respectively.

We also tested more specific language around raising revenue through increased taxes on the wealthy to improve the security of Medicare’s finances and strengthen Social Security. Using a split-sample test, we randomly assigned voters to two groups in order to ascertain support or opposition to 1) increasing the Medicare payroll tax on the wealthiest of Americans, and 2) raising taxes on corporations and the wealthiest Americans to shore up Social Security. Voters in the first group, Split A, saw the questions with the proposed annual income threshold of $400,000 or more for increased taxes, while voters in the second group, Split B, did not.

Ultimately, we find no less than two-thirds of voters overall support each version of the two proposed reforms. In the first group, voters support raising the Medicare payroll tax to 5 percent by a +74-point margin, and back raising taxes on corporations and the wealthiest to increase Social Security’s solvency, also by a +74-point margin. Similarly, voters across the second group support raising the Medicare payroll tax to 5 percent by a +57-point margin and raising taxes on corporations and the wealthiest to increase Social Security’s solvency by a +60-point margin.

A full breakdown of these results and the language used in this experiment can be found here.

Additionally, we tested a proposal to expand Social Security benefits by $200 a month for all beneficiaries. We find that a majority of voters support this expansion, by a +48-point margin. Across partisanship, nearly three-fourths of Democrats back this proposal (a +59-point margin), while Independents and Republicans support it by a +45-point and a +40-point margin, respectively.

This poll, along with many others, underscores the value of programs like Social Security and Medicare to voters. As lawmakers in Congress continue discussing changes to these programs, and with the debt ceiling deadline looming, voters have made it clear they want to protect these programs and ensure their financial solvency for future generations. Voter appetite for reform does not extend to program cuts but instead hinges on expanding benefits to continue assisting retirees and disabled individuals to keep up with the rapidly increasing cost of living.

Isa Alomran is lead analyst at Data for Progress.

Kevin Hanley is a polling analyst at Data for Progress.