Voters Remain Supportive of Supplemental Funding to the IRS, Despite House Republicans’ Multiple Attempts at Repealing It

By Rob Todaro and Lew Blank

As part of the Inflation Reduction Act of 2022, Congress allocated nearly $80 billion in supplemental funding over the next 10 years to the Internal Revenue Service (IRS) so that it can modernize its operation, improve customer service for taxpayers, and increase law enforcement to recover unpaid taxes from corporations and the wealthiest Americans. The IRS has also announced that it plans to use this funding to create a free, government-run tax filing system so that Americans do not have to pay for tax return preparation services from companies like H&R Block and TurboTax.

In January of this year, as one of their first acts as the majority party, House Republicans voted to cut funding for the IRS. Now, House Speaker Mike Johnson’s first order of business in his new role has been proposing to repeal more than $14 billion of the IRS’ supplemental funding to pay for additional military aid to Israel. This request to authorize military aid only on the basis of cutting domestic programs is unprecedented. And these bad-faith attacks on the IRS aren’t limited to just congressional Republicans: In the third national Republican presidential primary debate, candidate Nikki Haley falsely claimed that there are “87,000 IRS agents going after Middle America.”

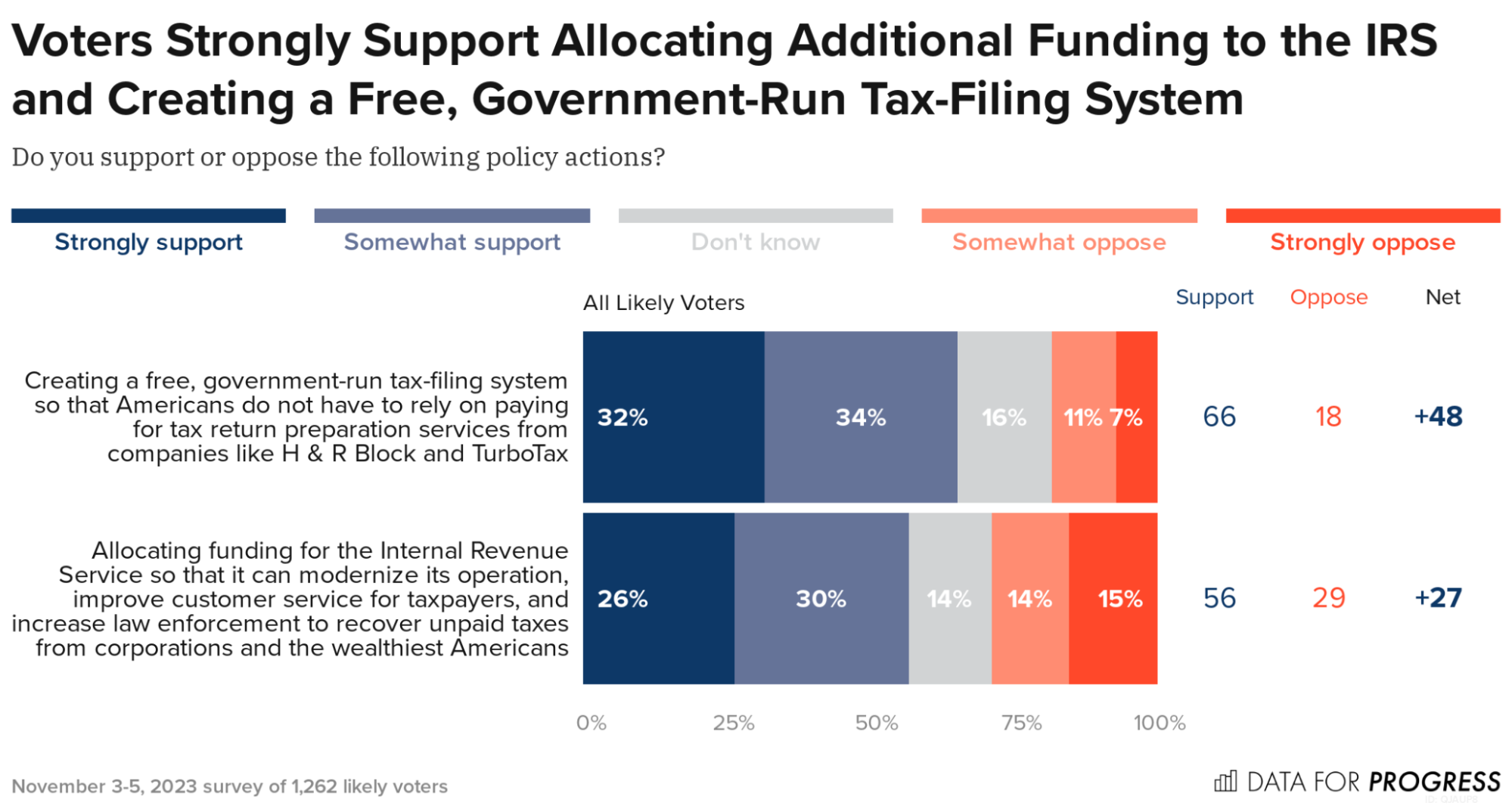

New Data for Progress polling finds that voters support the IRS funding for tax enforcement and the creation of a free, government-run tax filing system:

56% of voters, including a majority of Democrats (72%) and Independents (51%) and a plurality of Republicans (45%), support “allocating funding for the Internal Revenue Service so that it can modernize its operation, improve customer service for taxpayers, and increase law enforcement to recover unpaid taxes from corporations and the wealthiest Americans.”

66% of voters, including a majority of Democrats (75%), Independents (61%), and Republicans (58%), support “creating a free, government-run tax-filing system so that Americans do not have to rely on paying for tax return preparation services from companies like H&R Block and TurboTax.”

By voting to rescind this critical funding, House Republicans are limiting the agency’s ability to crack down on tax fraud and simplify the tax filing process for everyday Americans. These findings emphasize that the supplemental IRS funding included in the Inflation Reduction Act is popular among voters, and Speaker Johnson is widely out of step with the American electorate.

Rob Todaro (@robtodaro) is the Communications Director at Data for Progress.

Lew Blank (@LewBlank) is a communications associate at Data for Progress.

Survey Methodology

From November 3 to 5, 2023, Data for Progress conducted a survey of 1,262 U.S. likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, geography, and voting history. The survey was conducted in English. The margin of error is ±3 percentage points.